Financial Reports and SEC Filings

Financial Reports & SEC FilingsQ3 2011 Results

Ford Earns $1.6 Billion Net Income in Third Quarter 2011; Continues Building Foundation for Global Growth

Download Full Financial Release (PDF)

Download Slides (PDF)

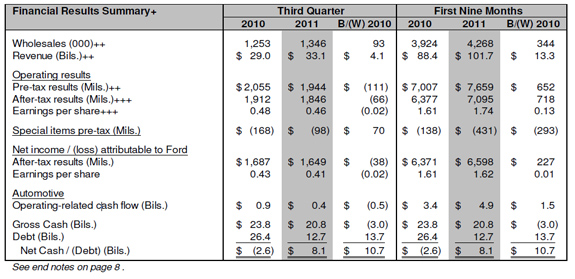

- Third quarter net income was $1.6 billion, or 41 cents per share, a $38 million decrease from third quarter 2010. Pre-tax operating profit was $1.9 billion, or 46 cents per share, a decrease of $111 million from third quarter 2010. Ford has posted a pre-tax operating profit for nine consecutive quarters.

- Automotive pre-tax operating profit was $1.3 billion for the third quarter, an increase of $45 million from third quarter 2010.

- Ford Credit reported a pre-tax operating profit of $581 million for the third quarter, a decrease of $185 million from third quarter 2010.

- Total Company revenue was $33.1 billion in the third quarter, up $4.1 billion from third quarter 2010.

- Ford generated positive Automotive operating-related cash flow of $400 million in the third quarter.

- Ford continued to reduce Automotive debt with an additional $1.3 billion of net debt reductions in the third quarter.

- Ford ended the third quarter with Automotive gross cash of $20.8 billion, a decline of $1.2 billion compared to the end of the 2011 second quarter. Ford’s Automotive gross cash exceeded debt by $8.1 billion, an improvement of $10.7 billion from the third quarter a year ago.

- Ford ended the third quarter with $31 billion in total Automotive liquidity.

- For full year results, Ford plans to deliver continued improvement in pre-tax operating profit and Automotive operating-related cash flow compared to 2010.

DEARBORN, Mich., Oct. 26, 2011 – Ford Motor Company [NYSE: F] today reported third quarter 2011 net income of $1.6 billion, or 41 cents per share, a decrease of $38 million, or 2 cents per share, versus third quarter 2010. During the quarter, Ford continued to generate solid profits, strengthen its balance sheet, invest for future growth, as well as take actions to improve its competitiveness.

“We delivered solid results for the third quarter despite an uncertain business environment by continuing to serve our customers around the world with best-in-class vehicles,” said Alan Mulally, Ford president and CEO. “We accomplished this while continuing to invest for future growth and focusing on developing outstanding products with segment-leading quality, fuel efficiency, safety, smart design and value.”

Third quarter 2011 pre-tax operating profit was $1.9 billion, or 46 cents per share, a decrease of $111 million, or 2 cents per share, from third quarter 2010. Improved total Automotive results were more than offset by anticipated reductions in Financial Services.

Within Automotive results, pre-tax operating profit was reduced by about $350 million for unrealized mark-to-market adjustments on commodity hedges for future periods. These adjustments occurred because of the significant decline in commodity prices near the end of September. This is a non-cash charge that will either reverse should commodity prices increase or be offset by the benefit of lower commodity prices in the future.

For the first nine months, Ford earned a pre-tax operating profit of $7.7 billion, net income of $6.6 billion and reported Automotive operating-related cash flow of $4.9 billion. Ford continued to grow volume and revenue during the period.

Ford’s third quarter net income was affected by unfavorable special items of $98 million. The special items include personnel reduction actions, Mercury and other dealer-related actions in North America.

Third quarter Ford Credit pre-tax operating profit was $581 million, a decrease of $185 million from third quarter 2010, consistent with previous guidance.

Third quarter total Automotive pre-tax profit was $1.3 billion, an increase of $45 million from the same period a year ago. North America and South America reported pre-tax profits for the third quarter, while Europe and Asia Pacific and Africa posted a loss for the period.

Ford’s third quarter revenue was $33.1 billion, an increase of $4.1 billion from third quarter 2010. Ford generated positive Automotive operating-related cash flow of $400 million in the third quarter.

Ford also continued to strengthen its balance sheet, with a net reduction in Automotive debt of $1.3 billion in the third quarter. This included payment of the remaining $1.8 billion balance of secured Term Loan debt, which was offset partially by an increase in low-cost loans to support advanced technology. Ford ended the third quarter with $20.8 billion of Automotive gross cash, a decrease of $1.2 billion compared to June 30, 2011. Automotive gross cash exceeded debt by $8.1 billion, an improvement of $10.7 billion from a year ago. Ford’s Automotive liquidity totaled $31 billion.

“We remain well on track to deliver improved full year pre-tax operating profit and Automotive operating-related cash flow, consistent with our guidance,” said Lewis Booth, Ford executive vice president and chief financial officer. “Our liquidity remains strong, and we will continue to take actions when appropriate to strengthen our balance sheet.”

THIRD QUARTER 2011 HIGHLIGHTS

- Increased market share in the U.S. and Europe

- Ford continued as the best-selling brand in the U.S., with sales up 14 percent from a year ago

- Increased sales volume by more than 30 percent in Russia

- Increased market share in Asia Pacific Africa

- Launched 2.0-liter EcoBoost in North America in Explorer and Edge

- Eight Ford vehicles ranked in the top three in their respective segments in the U.S. in J.D. Power APEAL

- Launched new global Ranger in Asia Pacific Africa

- Started production of all-new Focus in Russia and new Fiesta in India

- Concluded four-year agreement with UAW that improves Company’s competitiveness in the U.S.

- Credit ratings upgraded

- Announced several new growth and other initiatives, including:

- $1 billion investment to build an integrated vehicle and engine manufacturing facility in Gujarat, India

- Started construction for a new $350 million transmission plant in Chongqing

- Initiated 50-50 joint venture in Russia with Sollers as of Oct. 1

- Memorandum of understanding with Toyota to collaborate on light truck and SUV hybrid system and next-generation in-car telematics services

- Two-year alliance with Zipcar, establishing Ford as the largest university vehicle partner of Zipcar’s U.S. car sharing network

AUTOMOTIVE SECTOR

Total Automotive pre-tax operating profit in the third quarter was $1.3 billion, an increase of $45 million from third quarter 2010. The increase is explained by higher net pricing in each of our Automotive operations, lower net interest expense, and favorable volume and mix in North and South America. This was offset partially by higher contribution costs – which include material costs, warranty expense, as well as freight and duty costs.

About two-thirds of the contribution cost increase is due to commodities. As previously noted, in addition to higher commodity costs, the company recognized unfavorable mark-to-market adjustments on commodity hedges of about $350 million driven by a sharp decline in commodity prices mainly in the latter part of September. Ford uses hedging to provide cash flow protection against volatility in commodity prices. Mark-to-market refers to the accounting practice of reflecting commodity hedges at their current market value. As commodity prices go up, the market value of Ford’s commodity hedges increases; as commodity prices go down, the market value of Ford’s hedges decreases. These changes in the market value of the company’s commodity hedges do not have an immediate cash impact, although the change in value is reflected in its current earnings.

Total vehicle wholesales in the third quarter were 1.3 million units, up 93,000 units from third quarter 2010, as every business segment reported higher wholesales.

Total Automotive revenue in the third quarter was $31.1 billion, up $4.4 billion from third quarter 2010.

North America: In the third quarter, North America reported a pre-tax operating profit of $1.6 billion, essentially unchanged from a year ago. Higher net pricing and favorable volume and mix were more than offset by higher contribution costs. These costs included higher commodity costs and hedging adjustments, and higher material costs excluding commodities mainly associated with our new products. Wholesales in the third quarter were 642,000 units, up 50,000 units from a year ago. Revenue in the third quarter was $18 billion, up $1.8 billion from a year ago.

South America: In the third quarter, South America reported a pre-tax operating profit of $276 million, compared with a profit of $241 million a year ago. The increase primarily reflects favorable net pricing, volume and mix, and other profits, offset partially by higher structural costs, driven by local inflation, and higher commodity costs. Wholesales in the third quarter were 133,000 units, up 17,000 units. Revenue in the third quarter was $3 billion, up $500 million from a year ago.

Europe: In the third quarter, Europe reported a pre-tax operating loss of $306 million, compared with a loss of $196 million a year ago. The decrease is explained by higher commodity costs, including hedging adjustments, as well as unfavorable exchange, partially offset by improved structural costs. Wholesales in the third quarter were 357,000 units, up 17,000 units. Revenue in the third quarter was $7.8 billion, up $1.6 billion from a year ago.

Asia Pacific Africa: In the third quarter, Asia Pacific Africa reported a pre-tax operating loss of

$43 million, compared with a profit of $30 million a year ago. The decline reflects higher costs, unfavorable volume and mix, mainly mix, and unfavorable exchange, offset partially by higher net pricing. Wholesales in the third quarter were 214,000 units, up 9,000 units. Revenue in the third quarter, which excludes sales at unconsolidated China joint ventures, was $2.3 billion, up $500 million from a year ago.

Other Automotive: In the third quarter, Ford reported a loss of $138 million, an improvement of $231 million from a year ago. The improvement is more than explained by lower net interest expense.

FINANCIAL SERVICES SECTOR

For the third quarter, the Financial Services sector reported a pre-tax operating profit of $605 million, a decrease of $156 million compared with third quarter 2010.

Ford Motor Credit Company: In the third quarter, Ford Credit reported a pre-tax operating profit of $581 million, a decrease of $185 million compared with the third quarter of 2010. The decrease in pre-tax earnings is more than explained by fewer leases being terminated and the related vehicles sold at a gain, and lower credit loss reserve reductions.

OUTLOOK

Ford remains focused on delivering the key aspects of the One Ford plan, which are unchanged:

- Aggressively restructuring to operate profitably at the current demand and changing model mix

- Accelerating the development of new products that customers want and value

- Financing the plan and improving the balance sheet

- Working together effectively as one team, leveraging Ford’s global assets

In the first nine months of 2011, the seasonally adjusted annual rate of sales was 12.8 million in the U.S. and 15.3 million in the 19 markets Ford tracks in Europe. Based on the latest outlook for industry volumes, Ford now forecasts the U.S. full year industry volume at 13 million units, compared with a range of 13 million to 13.5 million units previously. For the 19 markets Ford tracks in Europe, Ford now forecasts the industry volume at 15.2 million units, compared with a previous range of 14.8 million to 15.3 million units.

As reported with first and second quarter results, quality remains mixed due to some near-term issues in North America, which Ford is addressing. The company also said it is on track to achieve quality improvements in its international operations.

The company expects its full year U.S. total market share, its U.S. retail share of the retail market and European market share to be equal to or improved from 2010. In the first nine months, Ford’s U.S. total market share was 16.5 percent, its U.S. retail share of the retail market was 13.9 percent and European market share was 8.3 percent.

Ford said its third quarter and first nine-month performance was solid, and the company remains well on track to deliver continued improvement for full year pre-tax operating profit and Automotive operating-related cash flow compared with 2010. In 2010, the company reported a full year pre-tax operating profit of $8.3 billion and Automotive operating-related cash flow of $4.4 billion.

Based on the company’s most recent assessment, Ford expects its structural costs to be about $1.6 billion higher than 2010. As a result of the recent hedging adjustments, Ford expects commodity costs to be about $2.2 billion higher than 2010. Ford now expects its full year Automotive operating margin will be about 5.7 percent, compared to the 6.1 percent Ford achieved in 2010. This is due primarily to the impact of commodity hedging adjustments. Automotive operating margin through the first nine months of 2011 was 6.5 percent.

Ford expects 2011 capital expenditures to be about $4.6 billion, as the company realizes efficiencies from its global product development processes. The company remains on track with its product plans. Capital spending in the first nine months was $3.1 billion.

Ford expects total company fourth quarter production to be about 1.4 million units, up 22,000 units from a year ago. Fourth quarter production in Asia Pacific Africa is being affected by flooding in Thailand. Although the company’s joint venture Auto Alliance Thailand assembly plant is not affected, the flood is causing parts shortages that have forced it to suspend production. Ford is working closely with its affected suppliers to return to production as quickly as possible and to minimize any potential impact in other regions. This forecast reflects the company’s best projection at this time. Should the outlook change materially, the company will update its forecast accordingly.

“We are making consistent progress on our commitment to deliver profitable growth for all,” said Mulally. “Going forward, we are focused on aggressively managing short-term challenges and opportunities and we remain committed to delivering our mid-decade plan and serving a growing group of Ford customers around the world.”

Ford’s planning assumptions and key metrics, and production volumes, are shown below:

+ The financial results discussed herein are presented on a preliminary basis; final data will be included in Ford’s Quarterly Report on Form 10-Q for the period ended Sept. 30, 2011. The following information applies to the information throughout this release:

- Pre-tax operating results exclude special items unless otherwise noted.

- See tables following the “Safe Harbor/Risk Factors” for the nature and amount of special items, and reconciliation of items designated as “excluding special items” to U.S. generally accepted accounting principles (“GAAP”). Also see the tables for reconciliation to GAAP of Automotive gross cash and operating-related cash flow.

- Discussion of overall Automotive cost changes is measured primarily at present-year exchange and excludes special items and discontinued operations; in addition, costs that vary directly with production volume, such as material, freight, and warranty costs, are measured at present-year volume and mix.

- As a result of the sale of Volvo, 2010 results for Volvo were reported as special items and excluded from wholesales, revenue and operating results.

- Wholesale unit sales and production volumes include the sale or production of Ford-brand and JMC-brand vehicles by unconsolidated affiliates. JMC refers to our Chinese joint venture, Jiangling Motors Corporation. See materials supporting the Oct. 26, 2011 conference calls at www.shareholder.ford.com for further discussion of wholesale unit volumes.

++ Excludes special items.

+++ Excludes special items and “Income/(Loss) attributable to non-controlling interests.” See tables following “Safe Harbor/Risk Factors” for the nature and amount of these special items and reconciliation to GAAP.

Safe Harbor/Risk Factors

Statements included herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation:

- Decline in industry sales volume, particularly in the United States or Europe, due to financial crisis, recession, geo-political events, or other factors;

- Decline in market share or failure to achieve growth;

- Lower-than-anticipated market acceptance of new or existing products;

- An increase in or acceleration of market shift beyond our current planning assumptions from sales of trucks, medium- and large-sized utilities, or other more profitable vehicles, particularly in the United States;

- An increase in fuel prices, continued volatility of fuel prices, or reduced availability of fuel;

- Continued or increased price competition resulting from industry overcapacity, currency fluctuations, or other factors;

- Adverse effects from the bankruptcy, insolvency, or government-funded restructuring of, change in ownership or control of, or alliances entered into by a major competitor;

- Fluctuations in foreign currency exchange rates, commodity prices, and interest rates;

- Economic distress of suppliers that may require us to provide substantial financial support or take other measures to ensure supplies of components and could increase our costs, affect our liquidity, or cause production constraints or disruptions;

- Single-source supply of components or materials;

- Labor or other constraints on our ability to maintain competitive cost structure;

- Work stoppages at Ford or supplier facilities or other interruptions of production;

- Substantial pension and postretirement health care and life insurance liabilities impairing our liquidity or financial condition;

- Worse-than-assumed economic and demographic experience for our postretirement benefit plans (e.g., discount rates or investment returns);

- Restriction on use of tax attributes from tax law "ownership change;"

- The discovery of defects in vehicles resulting in delays in new model launches, recall campaigns, reputational damage, or increased warranty costs;

- Increased safety, emissions, fuel economy, or other regulation resulting in higher costs, cash expenditures, and/or sales restrictions;

- Unusual or significant litigation, governmental investigations or adverse publicity arising out of alleged defects in our products, perceived environmental impacts, or otherwise;

- A change in our requirements for parts where we have long-term supply arrangements committing us to purchase minimum or fixed quantities of certain parts, or to pay a minimum amount to the seller ("take-or-pay" contracts);

- Adverse effects on our results from a decrease in or cessation or clawback of government incentives related to investments;

- Adverse effects on our operations resulting from certain geo-political or other events;

- Inherent limitations of internal controls impacting financial statements and safeguarding of assets;

- Substantial levels of Automotive indebtedness adversely affecting our financial condition or preventing us from fulfilling our debt obligations;

- Failure of financial institutions to fulfill commitments under committed credit facilities;

- Inability of Ford Credit to access debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts due to credit rating downgrades, market volatility, market disruption, regulatory requirements, or other factors;

- Higher-than-expected credit losses;

- Increased competition from banks or other financial institutions seeking to increase their share of financing Ford vehicles;

- Collection and servicing problems related to finance receivables and net investment in operating leases;

- Lower-than-anticipated residual values or higher-than-expected return volumes for leased vehicles;

- Imposition of additional costs or restrictions due to the Dodd-Frank Wall Street Reform and Consumer Protection Act ("Act") and its implementing rules and regulations;

- New or increased credit, consumer, or data protection or other regulations resulting in higher costs and/or additional financing restrictions; and

- Inability of Ford Credit to obtain competitive funding.

Ford cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Ford's forward-looking statements speak only as of the date of initial issuance, and Ford does not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events or otherwise. For additional discussion of these risks, see "Item 1A . Risk Factors" of Ford's Annual Report on Form 10-K for the year ended December 31, 2010.

CONFERENCE CALL DETAILS

Ford Motor Company [NYSE:F] releases its preliminary third quarter 2011 financial results at 7 a.m. EDT today. The following briefings will be conducted after the announcement:

At 9 a.m. EDT, Alan Mulally, Ford president and CEO, and Lewis Booth, Ford executive vice president and chief financial officer, will host a conference call for the investment community and news media to discuss the 2011 third quarter.

At 11 a.m. EDT, Bob Shanks, Ford vice president and controller, Neil Schloss, Ford vice president and treasurer, and Mike Seneski, chief financial officer, Ford Motor Credit Company, will host a conference call for fixed income analysts and investors.

Listen-only presentations and supporting materials will be available on the Internet at www.shareholder.ford.com. Representatives of the news media and the investment community participating by teleconference will have the opportunity to ask questions following the presentations.

Access Information – Wednesday, Oct. 26

Earnings Call: 9 a.m. EDT

Toll Free: 866.318.8620

International: 617.399.5139

Earnings Passcode: “Ford Earnings”

Fixed Income: 11 a.m. EDT

Toll Free: 866.318.8612

International: 617.399.5131

Fixed Income Passcode: “Ford Fixed Income”

Replays – Available after 2 p.m. the day of the event through Wednesday, November 2.

www.shareholder.ford.com

Toll Free: 888.286.8010

International: 617.801.6888

Passcodes:

Earnings: 50835972

Fixed Income: 79131521

About Ford Motor Company

Ford Motor Company, a global automotive industry leader based in Dearborn, Mich., manufactures or distributes automobiles across six continents. With about 166,000 employees and about 70 plants worldwide, the company’s automotive brands include Ford and Lincoln. The company provides financial services through Ford Motor Credit Company. For more information regarding Ford’s products, please visit www.ford.com.

# # #