U.S. Energy Security

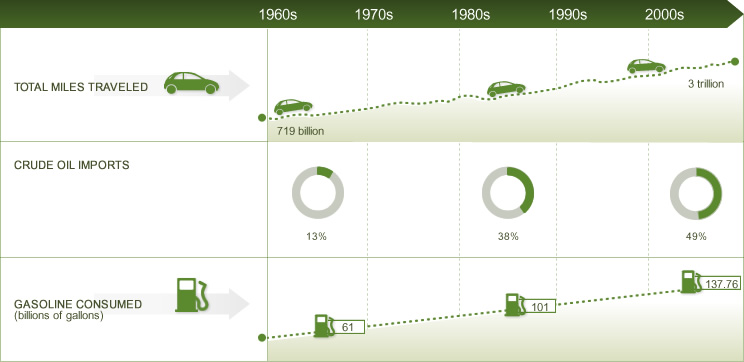

For many years, U.S. consumers and politicians have been concerned about energy security, due to the country’s continuing dependence on imported foreign oil. These concerns have been based on a trend of increasing consumption of crude oil in the form of gasoline for transportation and increasing crude oil imports in the U.S. since the 1960s (see Figure 1 below). Unlike the utility sector, which has a diverse energy portfolio, light-duty transportation is approximately 95 percent reliant on crude oil. This dominance of crude oil, coupled with the continued reliance on foreign countries for supply, is at the core of the U.S. energy security concerns. Furthermore, instability in the Middle East, one of the world’s primary oil-producing regions, as well as the high and volatile price of gasoline in the U.S., also feed these concerns.

In the first quarter of 2012, continued supply disruptions and instability in the Middle East and Africa contributed to a significant increase in world crude prices, resulting in record-high gasoline prices during 2012. However, more recent trends in the consumption of crude oil for transportation in the U.S., driven in part by increases in vehicle fuel efficiency, as well as increases in the production of oil in the U.S., suggest that U.S. energy security will become less of an issue in the future. In fact, the International Energy Administration recently released a report that predicts that the U.S. will be the largest global producer of oil by the mid-2020s, and by 2030 will be a net exporter of oil. If this prediction holds true, the U.S., which now imports about 20 percent of its total energy needs, would become energy self-sufficient in the coming decades.1

The U.S. marketplace has also seen the widespread penetration of renewable fuel use over the past 10 years. Today more than 90 percent of the gasoline offered for sale at retail refueling stations contains 10 percent ethanol (E10) by volume. The Energy Independence and Security Act of 2007 mandated increasingly greater volumes of renewable fuel; ethanol is currently the primary renewable fuel of choice. It should be noted that the widespread use of E10 is only possible because the vast majority of public retail refueling stations have dispensing and tank infrastructure that is compatible with E10, and more than 95 percent of the on-road vehicle fleet today is able to operate on gasoline containing 10 percent ethanol. Discussions of the widespread availability of higher blends of ethanol fuel will require further improvements in retail refueling infrastructure and vehicle compatibility.

Figure 1 below shows that increases in fuel efficiency over the years have largely compensated for the increase in vehicle miles traveled. Since the 1970s, the fuel efficiency of new passenger cars more than doubled, and fuel economy rates in trucks have increased more than 50 percent. As a result, though vehicle miles traveled increased by a factor of four, gasoline consumption increased by only a little over a factor of two.

Figure 2 shows that U.S. demand for crude oil has declined in recent years. The economic downturn, improvements in vehicle fuel efficiency, and changes in consumer behavior have contributed to this decline.

Nonetheless, for the time being, energy security remains a serious concern for U.S. consumers and continues to drive their vehicle purchase behavior, including demand for more fuel-efficient vehicles.

Figure 1: Total Miles Traveled, Crude Oil Imports, and Gasoline Consumed

Figure 2: Crude Oil* Consumption, Imports and U.S. Production

* Note: includes crude oil and other petroleum products, including natural gas plant liquids, processing gain, fuel ethanol and biodiesel.

- International Energy Administration, World Energy Outlook 2012.